Enphase Energy Inc. (ENPH) stock saw a mild recovery in Q2 after plummeting to a low of $95 earlier this year.

The stock’s swing has been in line with the industry trends in recent years.Enphase Energy Inc. (ENPH) stock saw a mild recovery in Q2 after plummeting to a low of $95 earlier this year.

The stock’s swing has been in line with the industry trends in recent years, and in our ENPH stock forecast, we aim to provide a clearer understanding for you.

- What Does Enphase Do?

- Brief on the July 23,2024 Financial Results

- Enphase Struggling to Meet the Forecasted Earnings Mark

- How Have the Enphase Competitors Performed in 2024?

- Forecasts for Enphase Q3 and Q4

- Enphase Energy stock risks

Enphase (EPNH) has a strong financial background and its innovative solar energy solutions provide sufficient backing for its potential growth.

However, macroeconomic factors, slowing demand in Europe, and some legislative changes mean analysts’ Enphase stock forecasts have changed several times. In this analysis we will work on Enphase energy stock forecast.

What Does Enphase Do?

Enphase is a global energy technology company that initially started as a residential solar energy provider in 2006 . Although its customer base remains homeowners largely, it has grown to offer full alternative energy solutions.

Its core business revolves around designing, manufacturing, and selling home energy solutions for energy production, storage, control, and communication through a single Enphase-based system for homeowners.

The key to its success has been innovation in its microinverters and storage batteries. The company recently started shipping its latest IQ8 series microinverters and IQ 5P batteries to North America.

Enphase has been listed on NASDAQ (ENPH) since 2012 and is in our top renewable energy stocks

Brief on the July 23,2024 Financial Results

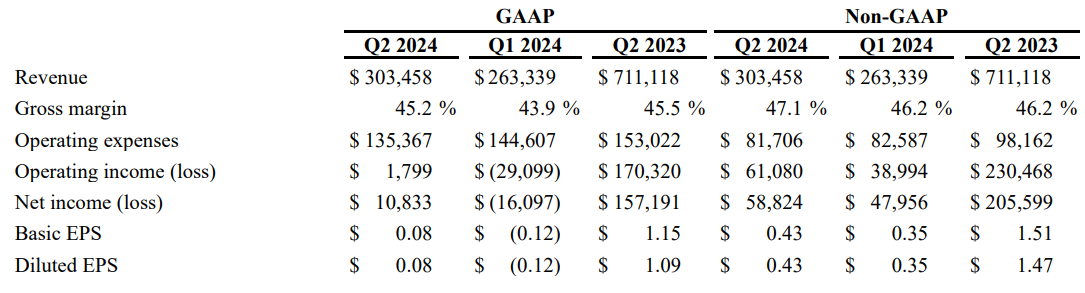

Looking at that table below there few key takeaways:

- Net income (loss) has decreased from Q1 $16,097 to Q2 $10,833

- Revenue went up in Q2 from Q1 2024

- Company has a good cash flow

- Gross margin is averaging around the 45% over the past quarters (steady gross margin)

Enphase Struggling to Meet the Forecasted Earnings Mark

Enphase stock has met the same fate as the alternative energy sector in the last couple of years. The current year 2024 has been particularly sluggish with a net revenue of $303 million in Q2 down from $566 million for Q2 2023.

Although Q2 financial results for the Enphase stock have shown some signs of recovery from gross revenue of $263 million and a net loss of $16 million, these results are below forecasted and last year’s results for the same period.

Its main market is in America where the company has shown positive results in both quarters this year.

The company’s reported Q2 net income is $10.8 million and the EPS is $0.08 but for the year the EPS remains negative ($0.04) so far.

But what has been really happening to the Enphase stock prices in the last couple of years?

- Higher interest rates on solar/green loans in recent years

- Supply chain disruptions and unbalanced consumer demand

- Lower green energy/net metering credits in California

- A stagnant solar market in Europe overall

These key factors have contributed to the downfall of the Enphase stock prices in recent years. However, that has been the case with the solar industry overall as well.

How Have the Enphase Competitors Performed in 2024?

Enphase’s main competitors in the solar energy industry include giants like Tesla and Huwaei. These firms hold significantly larger market bases and larger market caps than Enphase.

The competitors in the inverter field for Enphase are Sungrow (XSHE), Growatt New Energy, and Solaredge (SEDG). Its competitors in the energy storage sector are Wallbox, Chargepoint Holdings, JuiceBox, and EVBox.

Most of its competitors have struggled to match their historical performances. The solar and green energy industry has largely been sluggish in the last couple of years.

For example, SolarEdge (SEDG) is currently trading at $21.2 when its 52-week high point was $186.7 and it had crossed the $365 mark back in 2022.

Other solar energy solution providers like Sungrow and Growatt have also followed the trend.

Enphase energy stock forecast 2024 ?

Despite a struggling 2024 so far in terms of revenue and share prices, the Ephase stock forecasts are positive. It’s unlikely to reach its all-time peaks in the coming months but the long-term investment potential is there.

Here are a few key points to look at:

- The value of cash & cash equivalents and marketable securities is $1.69 billion.

- The value of free cash flow is $696 million in FY 2023.

- The gross margin ranges around 46% (FY 2023 and FY 2024 so far).

- 405 global patents and a growing global market.

Despite a dismal 2024 so far when it plummeted to the $96.88 mark, the Enphase stock should continue its recovery in the next two quarters.

Enphase holds a strong financial base with the bulk of its current assets in the cash and liquid securities. Its gross profit margin has also been lucrative historically. The leading solar energy solution provider also remains competitive in its innovation and product development front.

It means the long-term investment potential for ENPH looks bright even when its recent financial results have remained below par.

Enphase energy stock risks

Competition plays an important part in sectors such as Enphase. Manufacturers in Asian regions can offer similar product at a lower price which may affect Enphase’s sales.

A key strength of Enphase is its continuous expansion, such as its partnership with Octopus Energy which is extending its reach into the UK market and could impact its stock price.

Partnerships and expansion into new regions play a critical role in determining Enphase’s stock value.

In 2024, the stock reached a peak price of $141 on June 12, but as of August 14, it has dropped to $112.50, representing a 25.8% decline. While various factors could influence the stock price, based on past performance and Q2 financial results, we do not anticipate a significant risk of a further major price drop.

Summary

Enphase microinverter is a unique product and it’s all in one solution simplifies management and installation. The company has recently entered new markets, including Finland in May, with more expansions planned. The stock price typically ranges between $100 and $130, showing relatively moderate fluctuations compared to some other markets.

Whether to buy or sell the stock depends on various factors.