A Pip (Percentage in Point) is the smallest unit of a currency, and understanding of what it means and how it applies in currency trading is a key knowledge to know. If you are new to FX trading, this is the word you will hear most often.

When a currency price changes, it changes in pips. Instead of saying it has gone up by 1%, which is unclear, you would say it has gone up by 1 pip. If it changes by more than a decimal unit, a different term is used.

As we use miles or kilometers to measure distance, we use pips to measure changes in currency value.

One key thing to know about pips is that it stands for the fourth decimal place in a currency pair. For example, if the exchange rate is 1.2785, the 5 represents one pip.

What is a PIP in Forex?

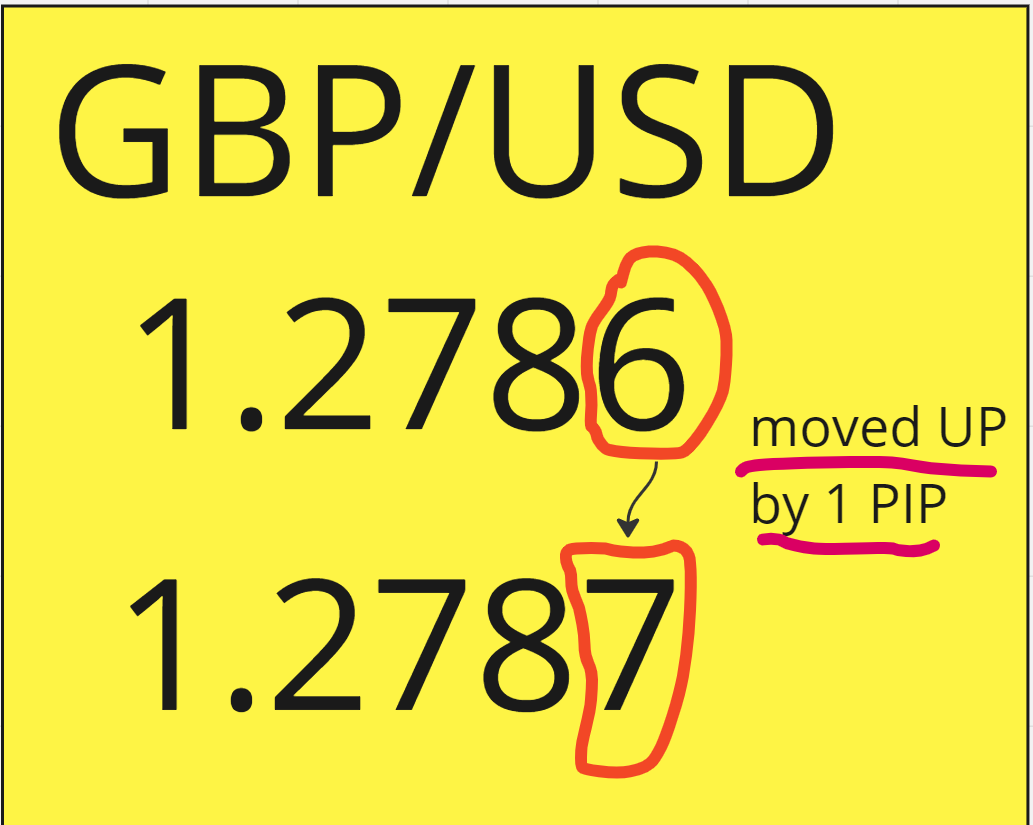

To understand it better, we will use the pair GBP/USD. If GBP/USD is currently at 1.2786 and it goes up to 1.2787 we say it has moved by one pip.

Now, the below will test your knowledge of PIP.

1. Example: EUR/USD is at 1.0856 and goes down to 1.0854.

How many pip movement did happen?

- 1

- 2

- 3

- 4

The correct answer is: 2. There was a drop of 2 pips.

2. Example: EUR/USD is at 1.0856 and goes upto 1.0859.

How many pip movement did happen?

- 1

- 2

- 3

- 4

The correct answer is: 3. There was a rise of 3 pip.

Japanese Yen Exception

The Japanese Yen is the only currency that has a two decimal place. For example, the USD/JPY is quoted as 157.13 unlike pairs such as USD/GBP 0.7835.

The pip on the Yen is the second decimal place which is 157.13 -> 3

The Importance of Pip in Forex Trading

Since, it is a measurement unit, the movements of Pips indicates profit or loss. If a currency pair, had a gain in pips this can result in a profit. When you are trading currency always look at the movement of the pips in the past, find out how much did it move and what caused the move.

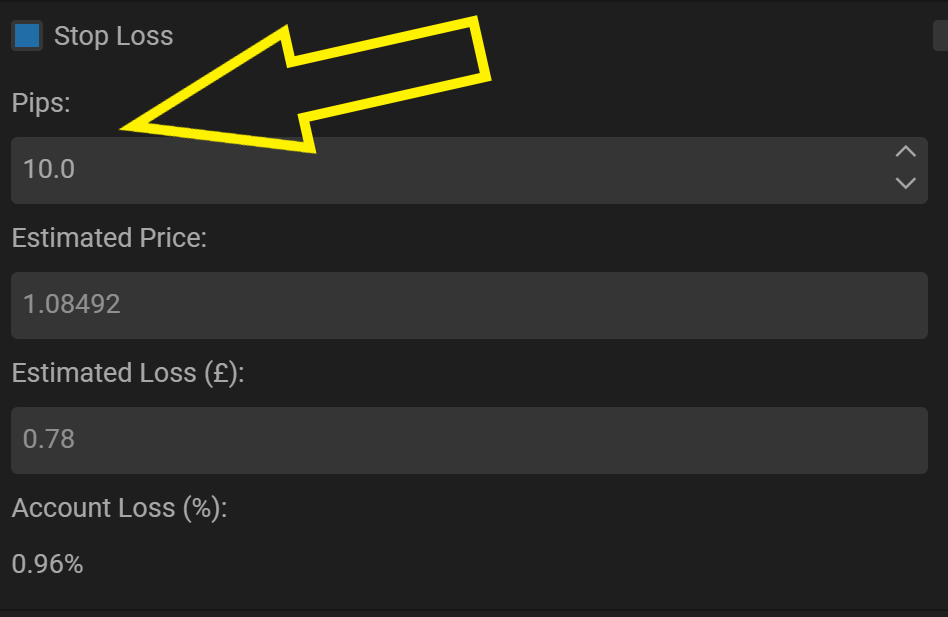

Understanding what Pip means is helpful, for instance when you are going to set a Stop Loss or Take Profit some trading platforms require you to enter the number of pips for these settings. This is important to improve your forex trading positions.

For example, the Stop Loss option in the picture below asks you to enter the number of pips at which you want the position to close. In the diagram, we have set the Stop-Loss to be executed when 10 Pips have changed. This means if there is a movement of 10 Pips the position will close.

What is a good number of pips to consider for a forex trade?

There’s no simple answer to this question because it depends on various factors and especially the lot size (which I’ll explain below). While having a large pip movement can result in significant profit, at the same time it can also yield high loss.

Don’t stress too much about the number of pips. Focus more on your analysis and why you’re making the trade.

Lot Sizes

Now, that the understanding of pip is clear we will talk about lot sizes. When you go shopping for oranges you will buy a certain amount and this is usually measured in kgs. In Forex, when you buy or sell the amount is called “lots“.

There are different lot sizes: Standard, mini, micro and nano and each have a different value.

| Lot Size | Units | Description |

|---|---|---|

| Standard Lot | 100,000 units | 100,000 units of the base currency. |

| Mini Lot | 10,000 units | 10,000 units of the base currency. |

| Micro Lot | 1,000 units | 1,000 units of the base currency. |

| Nano Lot | 100 units | 100 units of the base currency. |

Regardless of the lot size you are trading, always set up a stop-loss in the early stages. This will help you reduce losses.

You can trade larger lots with less money by using CFDs. To learn about CFDs and their basics, check our article.

How to keep track of Pip movement?

Currency is one of the markets where movement never stops, making it extremely difficult and time-consuming to track pip movements manually. As a trader, you want to be alerted when a certain pair experiences significant movement. To keep you aware Pip movement, we need to utilise a Forex screener.

A great feature of these tools is that they allow you to set up alerts and be notified if a pair moves, for example, by 10 pips. They also let you view all currency pairs at a glance.

Value of Pip and how it impacts a trade?

When a currency pair moves, its value goes up or down. Since a pip is the unit of measurement this means the value of pip has been impacted.

The value of the pip depends on two factors:

- Size of the position. This can be micro, mini or standard lot.

- The currency pair.

Size of the position, plays an important role over-here as the bigger the size a slight movement of the pair will have a huge impact on the profit/loss.

How does the Pip rises or drops in a currency?

What impacts the value of pip depends on several factors. This can be from political events, interest and inflation rates and many more external factor. If a currency value goes down it won’t go down at the same percentage across all other pair combination. It’s important to know what affects a currency’s rise or fall. It can help you open a better position.

Conclusion

A Pip (Percentage in Point) is the smallest unit of a currency. When a currency price changes, it is described in terms of pips, offering a clear and standardized way. It is the fourth decimal place on a currency, with the exception of the Japanese Yen (second decimal place)

Knowing the impact it has on a position is crucial. When you setup stop-loss some trading brokers offer the option to set a desired amount of pip you like the position to close.

Nowadays calculating the value of pip manually isn’t efficient so when you set up the stop-loss you can actually choose the exact amount instead of pip.

Forex screener are tools that monitor the FX market and alert you when pairs had a movement of x pips. It is a good practice to configure alerts on the pairs you are interested.

There are four lot sizes, standard, mini, micro and nano and lot sizes are quoted on the base currency.

The value of pip depends on the size and the currency pair. Larger positions mean that even slight pip movements can significantly impact profits or losses. Understanding the dynamics of pips and their impact on trades is good to know.

When new to trading, start small and try to follow the best practices.