Forex trading takes a long time to master. In this post, we will cover our top Forex trading tips to improve your positions.

Top 12 Forex Trading tips

1.Stop-loss; Stop-loss; use it all the time

One of the best early trading tips is to use stop-loss as much as you can. Stop-losses allows you to define a set amount you are willing to lose.

Familiars yourself with the stop-order feature of the broker platform, experiment using a demo account.

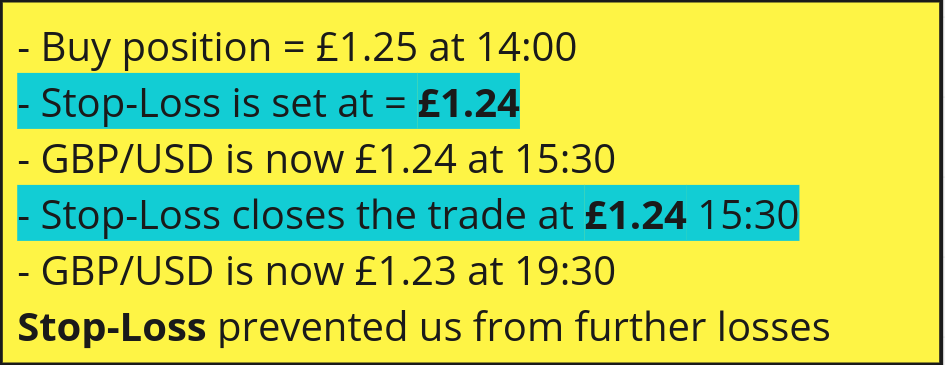

In the example below, Stop-Loss prevented us from further losses. Without the Stop-Loss we would have experienced more losses, as GBP/USD dropped to £1.23 at 19:30.

If you’re trading on a demo account, it’s important to also use Stop-Loss orders. Although it’s not real funds, refining your Stop-Loss strategy can be beneficial in the long term. This is why this is our first forex trading tip.

2. Treat Demo account like a real account

When you sign up with a broker, you have the option to choose the type of account you want. One option is a demo account. Demo forex trading accounts are funded with virtual money, so you don’t need to deposit any real money.

Demo accounts provide the same experience as real accounts, but with the advantage that your losses do not affect your actual funds.

While, it is funded by virtual money it’s good to follow the below points:

- Consider the virtual funds as real. Treat them as seriously as real money in your account.

- Demo account usually comes with a £10,000 virtual fund. Adjust it to the amount you think you will use in a real account. Now you will treat your positions more seriously.

- Examine your losses closely. Analyze, learn, and adapt from each loss to improve your trading strategy.

- Set a date when you will switch over to a real account.

3. Understand economic calendar

Economic calendar plays a critical part when trading. Economic calendar includes events that can impact the movement of a pair.

It’s a good practice to find out the event dates relevant to your pair.

For instance, if you’re trading GBP/USD find out the events related to GBP and USD. I personally do not open a position on the time of these events as the reaction of the market cannot be predicted.

4. Manage your emotions

There are many forex trading tips but one that be applied to every trading is managing emotions. Opening positions based on emotions is very risky. When you trade emotionally, you often skip the necessary time and research required to make informed decisions. Sudden news can cause stock prices to fluctuate within seconds, tempting you to open a position immediately to follow the trend. But, the market usually pulls back and returns close to its original price.

For example, on May 13th, GameStop stock spiked by 200%. An emotional trader might jump in and buy immediately. However, this spike was triggered by a single Twitter post. In such cases, it’s better to wait and observe how the stock price changes over the next few days before making any decisions.

5. Document your trades profits/losses

Maintain a spreadsheet to track your positions outcome. You might be trading on multiple platforms and having an understanding of your overall profit/losses is important.

Trading platforms allow you to export your trading history, this can be simply exported onto a spreadsheet.

If you have made losses on a pair, investigate what factor was the cause of it and this applies to profit.

6.Trade few pairs in the beginning

Concentrate on one or two currency pairs is one the best forex trading tips. While it may seem tempting to open positions on multiple pairs, it’s more effective to allocate your time and energy to just a few.

Take the time to understand the resistance and support levels of these pairs, observe their reactions to market data, and identify the optimal trading times.

The foreign exchange (FX) market, unlike the stock market, fluctuations very often, making it crucial to familiarize yourself thoroughly with your chosen pairs.

Jack of all trades, master of none.

7. Don’t invest in many technical indicators

Technical indicators are great and help you in making a successful positions. As a newcomer to trading, start by using a few key technical indicators. If your trade is successful, review how each indicator contributed to your profit. There are few indicators that is worth looking into:

8. Diversify your currency pairs

After a while when you have a better understanding of your trading profit/losses, expand into new currency pairs. It could turn out you are better in other pairs. Have a look at Forex screener, it highlights the change of all currency pairs over a certain period (months,days, weeks).

9. Be patient

Patience is the most important thing when you start FX trading. It is possible to make a living from trading but it requires you to be careful and patient. Do not jump into positions without thoroughly reviewing them. If you suffer losses in a few trades, do not give up.

Instead, stop and analyze the reasons for the losses. Did you open the position without proper research? Was it a new currency pair? Did you forget to set up a stop-loss order?

You must identify the reasons for your losses. It will help you trade better in the future.

10. Look into a Forex Screener

12. Look into CFDs

To make a decent profit from currency trading, you need a decent capital to invest. CFD helps you open larger position. This is possible because of leverage.

Note: CFD trading comes with high risk and average of 73% traders make a loss.

Use a demo account at the beginning and always set a stop-loss.

13. Understand what factors impact Forex rates

Having a good knowledge of what factors causes a rate to rise or fall is important. This is why we have written a detailed article on the 6 factors that influence Forex rates . You don’t need to know each factor thoroughly but a general understanding will definitely have an impact.