The airline industry is heavily influenced by people’s travel lifestyle and events in politics. COVID-19 hit the airline industry hard. Stocks fell 60-70%. Airlines cut jobs and the market collapsed.

For many seasoned investors, this was an opportunity for a long-term trade. They viewed the sharp decline in stock prices as a chance to buy into the market at a discount, anticipating a recovery of the airline industry over time. While, airline industry offer similar service flights to passengers some are involved into different industries which this makes them more interesting.

This article will cover the airline stocks to invest. Our evaluation will consider several important criteria, including the recent growth of companies in the sector, the unique selling propositions that set certain airlines apart from their competitors, and the future growth prospects that may arise as the global travel industry recovers and evolves.

4 Airline stocks that should be on your radar

Rolls-Royce

Rolls-Royce is a leader and innovator in the airline engine manufacturing industry, with a long-standing reputation for producing high-quality, advanced engines. These engines power both civil aircraft, such as commercial airliners, and military jets. What make’s it a good stock for Airline investment is the fact their engines are unique and cannot be replaced by any other brand!

The Rolls-Royce stock has had a growth of more than 200% since the beginning of the year. Although it experienced a significant drop at the start of the pandemic, it is now on an upward trend.

Wizz Air Holdings

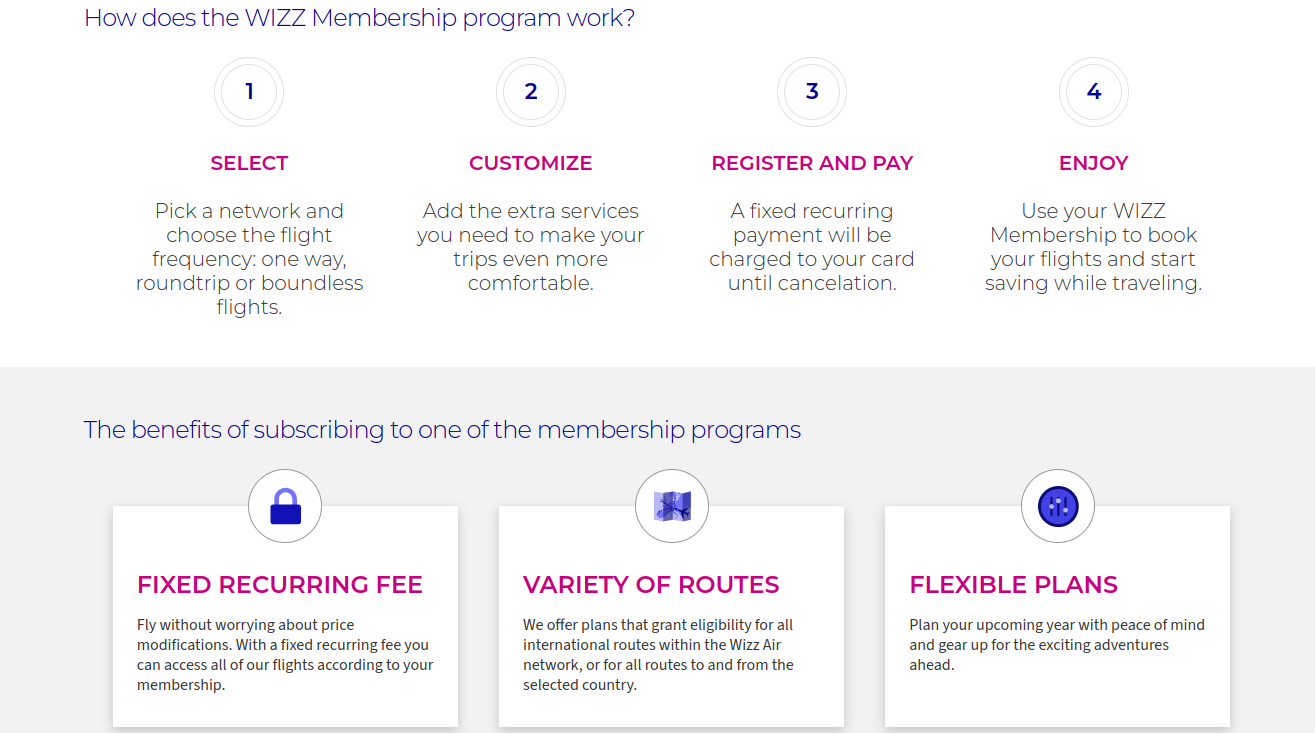

Known for its short flight trips and attractive travel destinations, Wizz Air has emerged as a prominent player in the European low-cost airline market. They recently announced a new “All You Can Fly scheme” which started in September that allows you to save money when travelling. The All you can Fly scheme is a subscription based model that lets you pay a monthly fee while you can travel once every month.

It is a great business model and if we conduct a SWOT analysis it is a strength. An airline travel stock that offers subscription model.

Alaska Air Group Inc

Alaska Air operates in thee different segments: Horizon, Regional and Mainline. It covers both long and short range distance travel journeys which caters both travel lifestyle.

Recently, it was cleared for acquisition of Hawaiian Airlines from the U.S Justice Department. This approval resulted in more than 10% stock growth and the next step is the approval from the U.S Transportation Department.

According to Simplywall.st the stock is trading below its estimated value of $39.52. They are currently expecting their earnings per share to grow from $3.25 to $5.25 for the full year.

Alaska Air Group is recognized for its strong management and strategic planning. For example, in the first quarter, the company generated solid revenue despite having a third of its fleet grounded for an entire month.

Jet2 PLC

Jet2 focuses on providing low-cost flights combined with attractive travel deals, making this combination a key element of its business model. The deal and low-cost flight combination is one of the key aspects of Jet2. As an airline stock it also offers other services such as:

- Jet2Holidays

- Jet2CityBreaks

- Jet2Villas

- Jet2carhire

- Jet2insurance

Jet2Villas, in particular, sees increased demand during the summer months. As the name suggests, Jet2Villas includes villa accommodations (great for summer family trips).

Jet2 is a great stock and company because it offers more than a flight, an experience. Our take is look at a long term position rather than short.

Note that Jet2CarHire is a service that compares car rental rates from various providers. You do not rent a car directly from Jet2CarHire. Instead, the service is powered by CarTrawler and is whitelabeled for Jet2.

What makes a good airline stock to invest?

A good airline is one that is diverse and offers more than flying services. Such as:

- Tour guides.

- Military aircrafts.

Future of Airline stock and industry

The competition in the airline industry remains high at the moment; this is because majority of the airline stocks have recovered. Airlines like Wizz Air are introducing innovative products, such as the “All You Can Fly” scheme, which could revolutionize how passengers purchase tickets. We may see more airlines adopting subscription-based models in the future.

Our outlook for the future of airline looks promising but stocks sock as Rolls-Royce industry that offers engine or Aircraft parts makes it more appealing. Travel industry is heavily influenced by the economic factors and investing in companies that are divers offers better return on investment.

If you are looking to start investing, have a read at our CFD trading introduction.