With the arrival of the new tax year in April 2024, many of us are keen on growing our money, and trading stocks is a great option. If you’re new to trading, you might have always told yourself, “Trading requires a significant amount of capital, and I don’t have enough money.” Well, this is where CFDs (contracts for differences) come into play.

please note: CFD trading comes with high risk, and on average 73% of retail investors accounts lose money when trading CFDs.

In this post, we will cover what is CFD trading and tips and hints to improve your trading journey.

- CFD definition in short

- What is the key differences compared to owning a share?

- What is leverage and how does it work in trading?

- How margin works in CFD trading

- How to reduce risks while trading CFD?

CFD definition in short

A contract for differences (CFD) acts as an agreement between you and a trading broker. For example, if you want to invest in Tesla stock, you will enter into an agreement with a broker like CMC Markets, IG, or FX Pro.

Compared to buying shares (investment) that requires you to have the stock price money in CFD you don’t.

If a stock is worth £500, you need to have £500, where as in CFD you don’t.

What is the key differences compared to owning a share?

Aside from the value of money you need, CFD has two key terms. SELL and BUY

1] SELL: If you think the price of a stock will go down, you can place a SELL (short) position.

If the price goes down, you will make a profit.

2] BUY: If you think the price of a stock will rise, you can place a BUY (long) position.

Example of a SELL

If Microsoft stock is trading at $480, and your analysis concludes that the value will drop to $420, you would select SELL.

Example of a BUY

This is the opposite of SELL, if it is trading at $480 and your analysis says it will be $550 you will place a BUY position.

What is leverage and how does it work in trading?

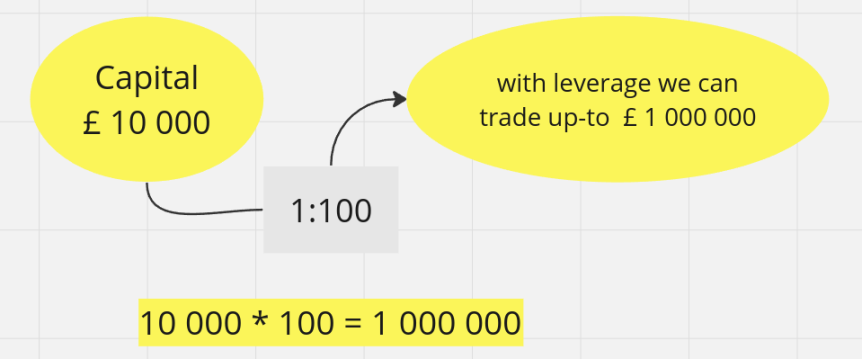

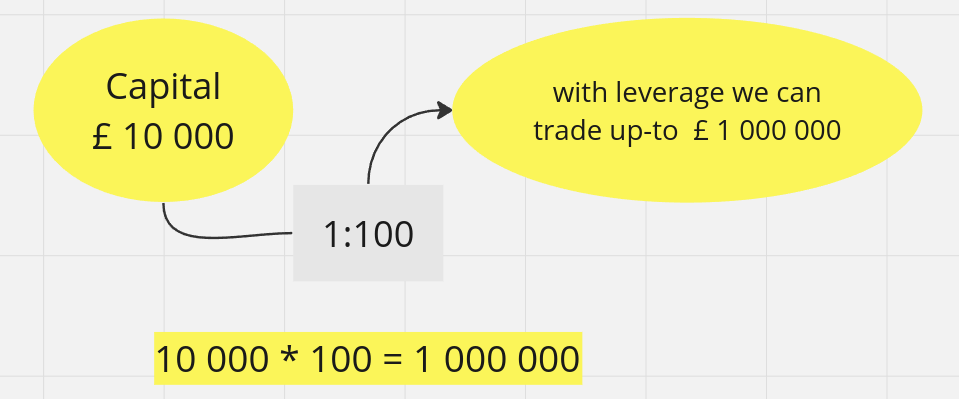

Another key term in CFD trading is leverage. Leverage is similar to a loan. Purchasing one stock worth £100 may not offer a huge profit, but what if the brokers lets you trade £10,000? This is where leverage comes to practice.

Leverage is expressed in ration such as 1:50, 1:100, 1:200, 1:250 or 1:500.

Let’s assume you are using a broker that is offering leverage of 1:100 and you have a capital of £10,000. This means you can trade up-to £ 1 000 000.

How margin works in CFD trading

If you are trading using CFDs, it is crucial to understand the close relationship between leverage and margin. Unlike traditional stock trading, where you typically need to have the entire value of the stock deposited, CFD trading operates on a margin system.

With margin trading, you’re only required to deposit a percentage of the total position value, known as the margin requirement. For instance, let’s say you want to open a position valued at £100,000 with leverage. Your broker might require you to deposit only 4% of that value as margin, which equates to £4,000.

This means that with just £4,000 as margin, you can control a position worth £100,000, thanks to the leverage provided by your broker. While leverage can amplify potential profits, it also magnifies potential losses, making it essential for traders to manage their risk carefully. It is important to find out how much loss you will make.

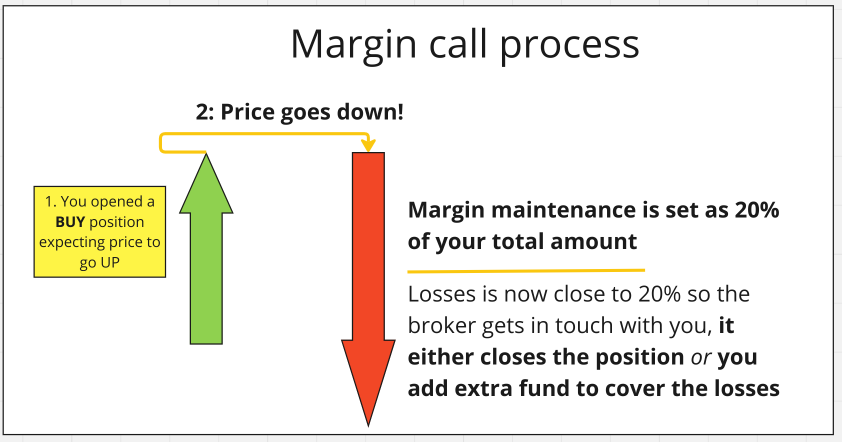

How does Margin Call works?

If we look at the example above, we opened a position worth £100,000 with just £4,000. Now, if the situation changes and our position starts making losses, it cannot continue making losses indefinitely. Hoping it turn back and make a profit…

This is where a margin call happens. The trader will get in touch with you asking you to fund more money or close the position as your losses are exceeding the margin maintenance of the account.

While margin call sounds terrifying, there are various steps you can do to prevent it from happening. Stop-loss is describe below and this feature will help such call to happen.

How to reduce risks while trading CFD?

Leverages in CFD is very tempting, with this temptation we should be very careful not to get excited and make huge loses. This is why we need to follow few strategies to reduce our loses:

1. Stop-loss is your best friend

Imagine opening a position on Brent Oil. Suddenly, during the trading hours a sudden change happens and this goes completely against your plan. A profit that was planned is now in losses.

This is where stop-losses come into play. A stop-loss allows you to set a percentage or specific amount of money that you are willing to lose. This is handy and one of the ways to prevent a margin call is stop-loss!

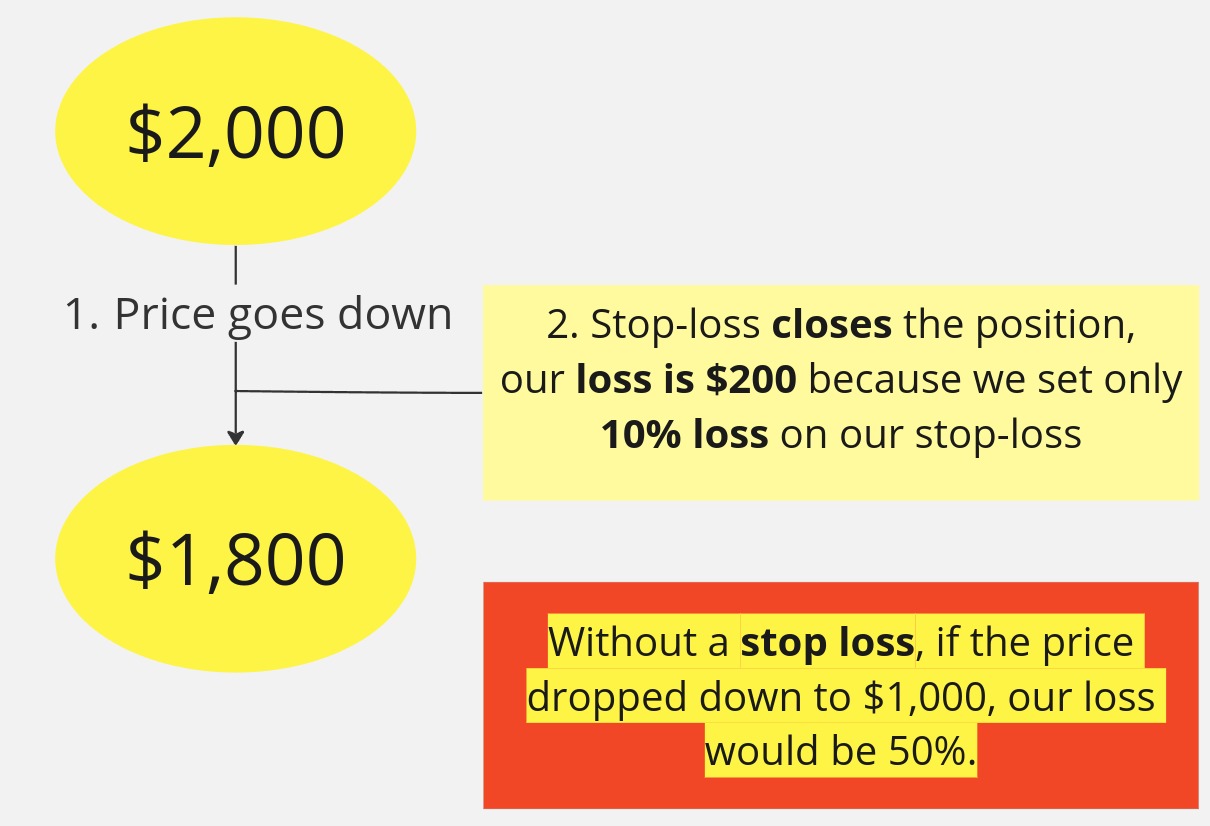

Example: if you anticipate Gold rising and buy a CFD contract at $2,000, but you don’t want to risk losing more than 10% on the trade, a stop-loss will be helpful.

The stop-loss features allows you to set a percentage of loss you willing to accept. When this percentage hits, the broker will automatically close the position thus preventing further losses.

This means that if the gold price drops more than 10%, the position will be closed, resulting in a loss of $200. This feature is advantageous as it helps with our trading plan and can be easily incorporated into all our trades.

Note: you can always edit the amount of the stop-loss. One practice is to set alerts on your position and based upon it adjust the stop-loss value.

If you are not sure how to use it, create a emo account. This features exists on all demo accounts so you can familiars yourself with it.

To find out examples how stop-loss plays on trading Forex, read more about it on our Forex beginner trading tips.

2. Start small

Always start small with trades. Starting small let’s your position losses to be small this offers you more time to analyse your trading strategy. If you are experience continuous losses invest more time in analysing the market. Don’t get excited to increase your position size when you make profits. Patience is key!

3. Keep an eye on your profit/losses

CFD let’s you trade with little deposit. For some early traders they might forget to keep on eye on their losses and they might think they are making profit with few successful trades. Have an excel document that tell’s your overall profit and losses. If you find out that you are making losses on specific market re-think your future positions.

Final re-cap

With Contracts for Difference (CFDs), trading becomes more accessible, and you can potentially make a decent profit.

Just keep in mind of the risks and always make sure you utilise safety features such as stop-loss.

I highly recommend using demo accounts as they allow you to familiarise yourself with the platform and understand how to execute Sell, Buy, and stop-loss orders before trading with a real account.

As always, please let us know if you would like us to write an article on a specific topic.