Spread betting vs CFD trading is one of the key things you might ask when you start trading. I for example when I started trading, I found it slightly confusing to decide which one to choose. As a result, in this post, I will cover the differences between spread betting and CFD trading and highlight key points that you should consider.

Please don’t be confused by the word “betting” in spread betting; it’s not like betting on sports. It needs the same amount of research and analysis as CFD trading.

Spread Betting vs CFD Trading the differences

Tax difference between Spread Betting and CFD Trading

A major difference between spread betting and CFD trading is the tax aspect, particularly in the UK. Spread betting is tax-free, while profits from CFD trading are subject to capital gains tax.

Since spread betting is classified as betting, it is completely tax-free according to HMRC regulations, making it a more attractive option for traders in the UK.

However, this difference is primarily tax-related and does not reflect operational differences between the two.

(Note: Tax regulations can change depending on individual circumstances.)

Who owns the stock?

In both CFD and Spread Betting you don’t own the stock. CFD (contract for difference) is technically a contract between you and the broker. Where as Spread Betting you bet on the price movement.

What about leverages?

Both include leverages, however the amount of leverage on a single broker might be different for CFD and Spread Betting. Now, this is a key important difference if you are starting to trade. Find out the leverage offered to both Spread Betting and CFD from your broker.

Is Spread Betting Easier Compared to CFD Trading?

No, despite the term “betting,” spread betting is not simpler than CFD trading. Like CFD trading or any other type of trading, spread betting requires extensive research and careful analysis before opening a position.

Here are some key points to consider:

- Research and Analysis: Both spread betting and CFD trading demand thorough research and analysis of the stock, FX pair, or any other asset you are trading.

- Leverage: The use of leverage in spread betting can amplify both potential profits and losses, making it crucial to approach it with the same seriousness and caution as CFD trading

Treat spread betting with the same care and attention as any other type of trading.

Difference between Spread betting compared to CFD when placing an order

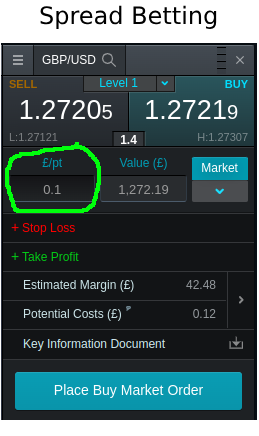

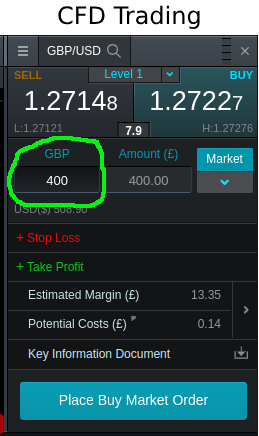

The two diagrams show the deal screens for Spread Betting and CFD Trading.

We can see that the difference is that for Spread Betting, it’s £/pt, whereas for CFD Trading, you are buying a specific amount of GBP.

Note: The margin required for placing a spread betting trade is usually higher than for CFD trading.

The values below represent the minimum amounts that can be entered.

Deal screen is from CMC Markets

The Similarities Between Spread Betting and CFD Trading

Derivatives

Both CFD and Spread betting are forms of derivative trading.

Leverage Usage

Both offer leverage, which can amplify profit and losses.

Short and Long Positions

Both methods allow traders to take short and long positions. A key point here is to find out the holding code of the broker. Holding cost can be expensive on certain stocks and brokers.

Market Access

The access to market depends on the broker. Some brokers have limited stocks for spread betting compared to CFD due to their complexity.

Using the table below we can find out the differences in a glance.

| Feature | Spread Betting | CFDs |

|---|---|---|

| Taxation | Tax-free in some regions for example in the U.K | Yes |

| Can you trade in the U.S.A? | No | No |

| Ownership | No ownership of the underlying asset | No ownership of the underlying asset |

| Leverage | Yes, can be slightly lower than CFDs | Yes |

| Market Variety | Depends on the broker you use | Depends on the broker you use. |

| Costs | Spread, overnight financing charges | Spread, commissions (on some markets), overnight charges |

| Regulatory Restrictions | Restricted in certain countries | More widely available globally |

| Trading Hours | 24-hour trading available on many markets | 24-hour trading available on many markets |

FAQs on CFD and Spread betting

Is Spread Betting legal in the UK?

Yes, Spread Betting is completely legal in the UK.

How to open a Spread Betting account?

You can open a spread betting account with any trading broker that offers this service. Always ensure you select the appropriate amount of leverage.